Orange juice crisis worsens - Current harvest forecast from Brazil confirms critical market situation

News General news

The latest forecasts from Brazil, the world's largest producer of orange juice and also the most important EU supplier with a global market share of 80 per cent, indicate a significant decline in the orange harvest for the 2024/2025 season. With an estimated decline of around 25 per cent compared to the previous year, this is the worst harvest in 36 years.

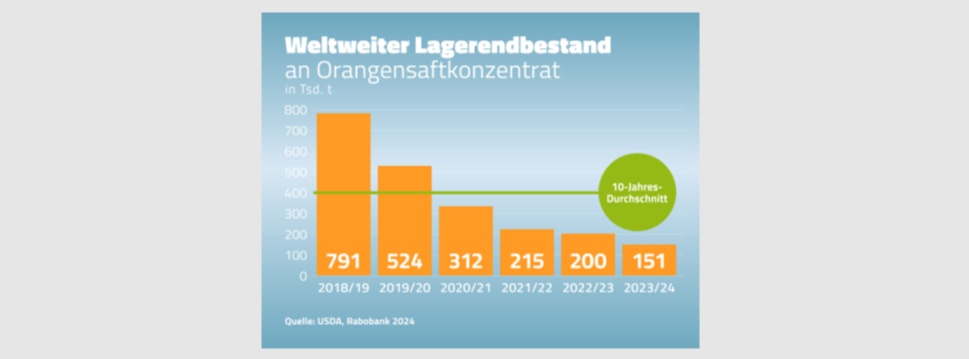

The continuous decline in Brazilian orange production in recent years has reduced stocks to zero and massively restricted the availability of orange juice concentrate. The volume recently forecast by Fundecitrus, the general association of the Brazilian citrus industry, for the 2024/2025 season represents another significant decline of around 25 per cent compared to the last harvest, which was also already below average. Compared to the annual production of 7 billion litres of orange juice, the 25 per cent represents a decrease of around 1.7 billion litres. This would mean that around four fewer litres of orange juice are available per EU citizen. By comparison, the per capita consumption of orange juice in Germany in 2023 was 6.8 litres.

If the current production forecast materialises, this would be the lowest harvest since 1988/1989. The reason for the continuing decline is climate change. The Brazilian citrus belt has been affected by the El Niño phenomenon for years. In the current season, the combination of high temperatures and a severe lack of water during the crucial flowering period led to a significantly lower number of fruits per tree. Overall, harvests have been declining since 2020 and are below the 10-year average.

Added to this is citrus greening, a disease that leads to the death of trees and thus destroys entire orange plantations. Between 40 and 80 per cent of orange trees in the Brazilian citrus belt are already affected. In addition, the global demand for orange juice remains high. The combination of a smaller harvest and unchanged demand is leading to a sharp rise in commodity prices. This development has a direct impact on the German market: the availability of orange juice concentrate remains critical and is likely to lead to further cost increases. Orange juice is currently trading at a premium of up to 150 per cent on the commodity exchanges compared to the beginning of 2022. The situation is not expected to ease over the next few years. The overall situation will not change in the short term, as the necessary reorganisation of the Brazilian citrus industry will take both time and financial investments

Despite these numerous challenges, the aim of fruit juice producers in Germany is to continue to offer consumers a wide range of high-quality and diverse products through innovation and adaptability. However, in view of the sustainable reorganisation of agriculture and the considerable cost increases in raw materials and logistics, which do not only affect the fruit juice industry, we will have to live with the reality of higher prices in Germany in the future. Orange juice remains expensive and is likely to become even more expensive.

The sometimes exponential cost increases along the entire value chain cannot be borne by the fruit juice industry alone. They must therefore be passed on to the food trade and thus to the end consumer in the form of price increases. Another option is to adjust the product range, for example by reducing the proportion of fruit juice and expanding the product selection to include cheaper alternatives..