One in four breweries threatened with insolvency - Industry survey by the German Brewers Association on the impact of the Corona pandemic

News General news

With increasing duration of the lockdown for the hospitality industry, which has been in place for almost six months, there are increasingly serious consequences for the German brewing industry. According to an industry survey by the German Brewers Association (DBB), one in four breweries (25 percent) now sees their existence at risk. The Corona crisis has hit the entire industry hard - companies of all sizes are reporting massive sales losses, short-time work and layoffs. According to the DBB's latest company survey, breweries' sales have slumped by an average of 33 percent from January to March 2021 inclusive. According to the association's current sample, breweries with a high proportion of catering business have been hit particularly hard. Due to the complete collapse of the draft beer market, establishments are complaining of sales declines of up to 85 percent at the peak. Only a very small number of breweries, which sell their beers mainly or exclusively through the on-trade, managed to avoid drastic losses. In general, however, bottled beer sales, which are largely stable but generally low-margin, cannot come close to offsetting the heavy losses in the food service business, from which breweries traditionally generate a large part of their value added and which is therefore necessary for the companies to operate profitably.

The survey makes it clear that the brewing industry has been more massively affected by the hospitality industry shutdown than any other industry. "There have not been collapses of this dimension in the German brewing industry since the end of World War II," says Holger Eichele, chief executive of the German Brewers Association. The collapse of a single market segment, as is now happening with draft beer, is unprecedented in the history of the brewing industry, he said. "After almost six months of a permanent lockdown, the catering business and parts of exports have completely collapsed, and there is no recovery of the market in sight because there is no perspective at all. The brewing industry's sales losses now add up to historic proportions," Eichele said.

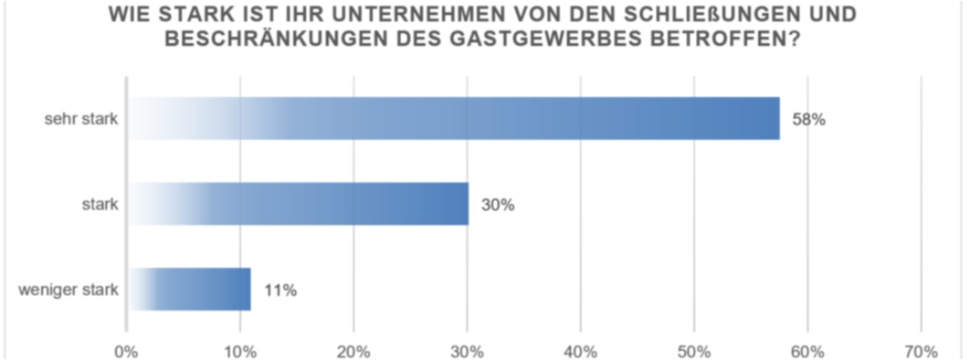

In the association's new sample, which is not representative but does a good job of representing the breadth of the industry, nearly 88 percent of brewers said they had been hit very hard (58 percent) or at least hard (30 percent) by hospitality industry closures and restrictions. When asked about a likely timeline for reopening outdoor dining, the vast majority of breweries indicated May as the expected date. Fifteen percent were more skeptical, fearing a delay in reopening the hospitality industry until at least June in light of the slow vaccination campaign.

Short-time work, layoffs, investment backlog, existential fears.

The consequences of the gastro-lockdown and the resulting loss of sales are hitting all business sectors in the breweries. More than 85 percent of the breweries surveyed have had to put their employees on short-time work, especially in the field. In four out of five breweries (79 percent), investments that are currently pending and important for the future have been postponed or cancelled altogether.

Just under a third of breweries (32 percent) have had to make compulsory redundancies since the start of the crisis. Due to the consequences of the pandemic, more than a quarter of breweries (26 percent) complain of bottlenecks in the procurement of bottles, beer crates and cardboard packaging, for example. On the other hand, bottlenecks have also arisen in production and in supplying bottled beer to the trade, as 16 percent of the breweries confirm.

When asked what impact the Corona crisis will have on the German brewing industry in the medium term, the industry is concerned in many areas. Most breweries (over 86 percent) fear higher taxes and duties in the future to consolidate public finances. Almost 84 percent of the breweries surveyed expect to lose numerous outlets in the German hospitality industry. As many as 73 percent of those surveyed also expect a significant increase in the number of business closures and insolvencies in the brewing industry. 75 percent of the brewers expect even stronger growth in online retailing and delivery services. On a positive note, more than 62 percent of the breweries surveyed expect an increased trend toward alcohol-free or low-alcohol beers. Non-alcoholic beers were the only notable segment to increase their market share in the crisis year 2020. The Brewers Association expects the market for non-alcoholic beers to continue to grow sustainably.

Government aid criticized as inadequate

In the DBB survey, just under 73 percent of the companies surveyed said they had applied for state aid. Almost 69 percent of the breweries have applied for bridging aid III, but so far only just under three percent have received it. A good 64 percent have received short-time allowance in full as applied for - here too, every fifth company has received only partial payment. The situation is even worse for the November and December allowances: Only just under 44 percent and just over 31 percent of the companies received these in full as applied for.

With regard to the aid measures taken so far by the federal government and the states for affected companies, 75 percent of those surveyed came to the conclusion that the aid is not sufficient overall. When asked what other measures should be taken for the brewing and restaurant industries in the Corona crisis, many brewers advocate a clear opening perspective for restaurants and events and call for progressive testing concepts. In addition to the waiver or reduction of the beer tax for all breweries and the return to the former beer tax volume scale for small businesses, a debureaucratization of economic policy is called for. With the national assistance a consideration of the entrepreneur salary is just as demanded as a reweighting of the fixed costs and lower thresholds with higher percentages with the bridging assistance III. In particular, the reimbursement for unsaleable draft beer urgently needs to be improved, the industry demands. In talks with the German government, the German Brewers Association had repeatedly pressed for additional, effective aid for breweries. More than 300 breweries from all over Germany had drawn attention in February in an open letter to the strained situation of the industry and pointed out that from week to week more and more breweries, brewery restaurants and specialized wholesalers are getting into existential distress through no fault of their own.