GEDAT figures: Despite lockdown end - Recovery remains below pre-Corona level

News General news

GEDAT figures show impact on beverage wholesale in out-of-home market

The March/April 2020 lockdown and the partial lockdown that took effect in November 2020 have taken a toll on the beverage industry. The partial lockdown was replaced on April 23, 2021, by the regulations of the federal emergency brake, which applied until the end of June 2021. The emergency brake imposes uniform Corona regulations based on incidence. This led to the first region-wide restaurant openings beginning in May 2021.

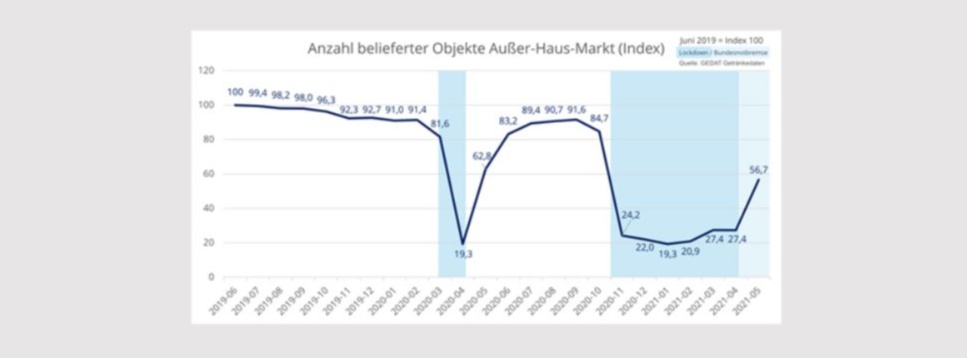

Evaluations by GEDAT Getränkedaten GmbH show how high the impact is for beverage wholesalers. The survey is based on the number of establishments supplied monthly in the out-of-home market by beverage wholesalers. The comparative values refer to June 2019 with an index of 100. GEDAT's figures show a significant increase in May 2021 of almost 20 index points compared to the previous month of April, which was 27.4. Despite this increase, the pre-Corona level still remains undercut by nearly 44 index points. The recovery should also not obscure the fact that a quantitative increase in the number of deliveries does not at the same time indicate an equally strong recovery in beverage wholesaler sales. The word from the industry is that the first orders from the catering trade in May were much smaller. Deliveries got off to a slow start and had to be made by making several trips with small stop sizes. That caused more expense at first. "The warehouses in the out-of-home market were simply empty, everything had to be ordered," they say.

It can be seen that in the pre-Corona period, in addition to the usual seasonal fluctuations, the number of monthly deliveries remains at a relatively constant level. Thus, in 2019, there is also the typical year-on-year high level in summer and a slight decrease towards winter. With the start of the first lockdown on March 19, 2020, the level drops drastically in one fell swoop. There is a drop of around 80% in April 2020. The subsequent recovery occurs after the end of the first lockdown starting in May 2020 and peaks in September 2020, although it remains below the original level of the comparable months of the previous year 2019.

A similar picture emerges with the start of the second partial lockdown in November 2020. Once again, the number of establishments supplied by beverage wholesalers in the out-of-home market drops dramatically. This time to a low of 19.3 points in January 2021, 65.4 points below October 2020, the last fully open month before the lockdown.

A look at establishments by business type shows different trajectories over time. For example, the number of deliveries in the first lockdown plummeted by a similar amount - about 85% in lodging and nearly 90% for establishments focused on beverage sales. Dining establishments fare a little better, down about 75% there. The subsequent recovery in the summer of 2020 is quite similar for the types of establishments. While May 2020 is still somewhat subdued, the number of establishments served increases again over the summer to comparable, albeit reduced, pre-lockdown levels.

The second lockdown, starting in November 2020, again resulted in sharp drops and is much longer at six months. There, establishments focused on beverage sales are among the biggest losers. With an index of 9.2 in January 2021, they sink even below the level of the first lockdown. The losses at lodging establishments are not quite as high. There, the index drops from 82.3 in October 2020 then to a low of 19.3 in January 2021, a loss of 63 index points. Establishments with a focus on food sales fare best, dropping to a low of 26.5 in January 2021, a loss of 59 points compared with October 2020, when the index was 85.5.